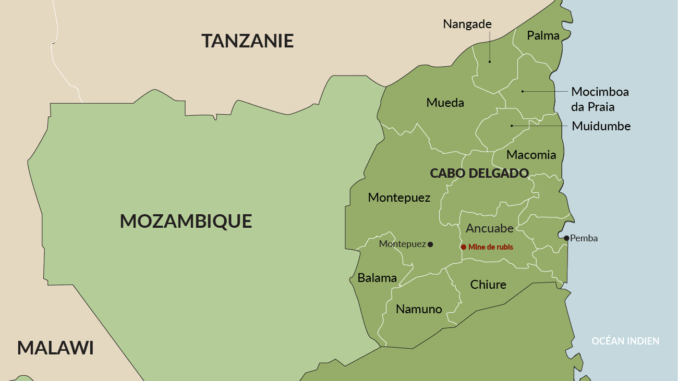

Mozambique’s Cabo Delgado province has witnessed a surge in used car imports from Japan, with 1,233 vehicles recorded in the first half of 2025 alone, all entering through the Negomano border post shared with Tanzania.

This marks a notable shift from 2024 figures, which saw 2,024 cars brought in over the entire year. The delegate of the Tax Authority in Cabo Delgado, Helmano Nhatitima, attributed the uptick in cross-border trade to heightened activity at the Mueda district post, which now sees roughly 168 vehicles arriving monthly. He stressed that this has translated into improved tax revenue for the province and the state at large.

The increased vehicle imports are also reflecting positively in state revenue collections. In 2023, the Cabo Delgado office of the Tax Authority exceeded its target by collecting 27.1 million meticais (€361,000), against a target of 24.1 million meticais (€321,000). That growth trajectory continued into 2024, with revenues hitting 36 million meticais (€480,000). These gains underscore the province’s strategic role in Mozambique’s broader fiscal strategy and the importance of cross-border trade in supporting national economic resilience amid regional instability.

Looking ahead, Mozambique’s 2025 State Budget and Economic and Social Plan outlines a series of tax reforms aimed at expanding domestic revenue. These include intensified audits, the inclusion of 200,000 new taxpayers, and the introduction of mechanisms to tax digital transactions and e-commerce activities. The reforms are expected to modernise the tax regime by strengthening institutional capacity, enhancing compliance in sectors such as tourism, electronic money services, and mineral and agricultural exports. The move reflects a broader shift towards fiscal sustainability and digital tax innovation in line with global best practices.