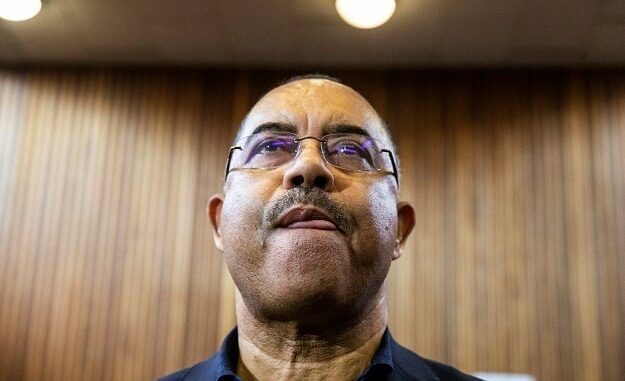

Manuel Chang, Mozambique’s former finance minister, is standing trial in a Brooklyn federal court over his alleged role in the infamous “tuna bond” scandal. Charged with bribery, fraud, and money laundering, Chang is accused of abusing his authority to secretly commit Mozambique to massive loans that were subsequently plundered.

The scandal, which came to light in 2016, involved $2 billion in “hidden debt” ostensibly meant to finance a tuna fishing fleet. Prosecutors allege that substantial portions of these loans were diverted to bribes and kickbacks, with Chang himself allegedly receiving $7 million.

This financial debacle has had devastating consequences for Mozambique’s economy. Once among the world’s fastest-growing economies, the country has seen stagnated growth, currency devaluation, and a loss of foreign investor confidence since the scandal emerged.

Chang’s trial is part of a broader legal aftermath that spans multiple continents. In Mozambique, several individuals, including the son of a former president, have been convicted. The U.S. cases have yielded mixed results, with some defendants pleading guilty while others were acquitted.

As the trial unfolds, Chang’s defense team argues that he signed loan guarantees at his government’s behest, denying any personal enrichment. The outcome of this high-profile case could have significant implications for international finance and governmental accountability in developing nations.