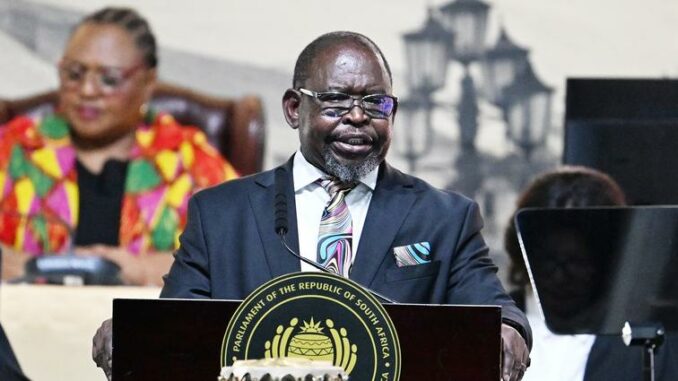

South Africa’s Finance minister, Enoch Godongwana, presented a revised budget on Wednesday March 12, but it was immediately rejected by several major political parties, despite a reduction in the proposed increase to the value-added tax (VAT).

The revised budget was aimed at resolving an impasse between the ruling African National Congress (ANC) and its largest coalition partner, the Democratic Alliance (DA), which had previously opposed the original budget plan. However, the continued opposition leaves the budget’s approval in limbo, with no clear way forward for the Government.

Initially, the Treasury had proposed a 2-percentage-point VAT increase to fund essential spending on health, transport, and education, but this was scaled back to a 0.5% increase for this year, followed by another increase in the next fiscal year. The DA made it clear that it would not support any permanent tax hikes unless they were temporary. The Economic Freedom Fighters (EFF) and the official opposition, uMkhonto we Sizwe, also rejected the new budget, leaving the ANC with little hope of securing the votes needed for approval.

The budget row highlights the challenges facing South Africa’s coalition government, which has struggled to maintain unity since the ANC lost its parliamentary majority for the first time since the end of apartheid. Political analysts predict that the impasse will set a precedent for continued deadlocks and prolonged negotiations, complicating governance further. Despite these challenges, Godongwana maintained that the VAT increase was the most viable solution to address the country’s growing fiscal pressures, with the budget set to generate an additional 28 billion rand ($1.53 billion) in the coming fiscal year, far short of the initial target.